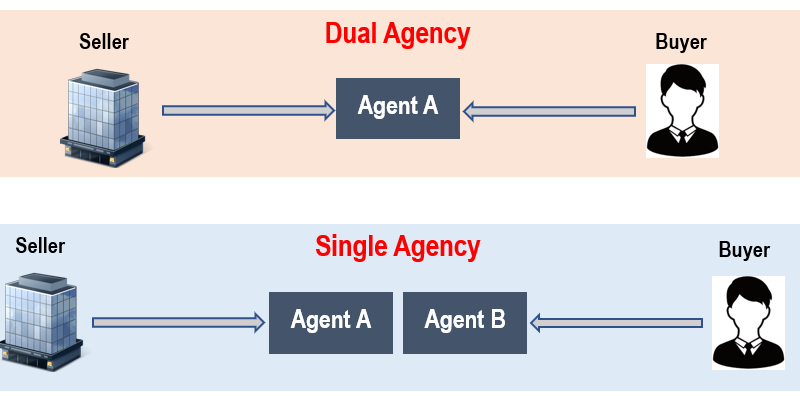

Same Agency Representing the Buyer and Seller of Real Estate

The Building Lots and Building Transaction Business Act (real estate brokerage regulation) stipulates that one in five employees of real estate companies must be a qualified Real Estate Notary (Takken). In order to run a real estate brokerage business in Japan, the law requires that at least one out of five employees must hold national qualification called Real Estate Notary (Takken). Takken holders are state-licensed professionals who are duty-bound to ensure that fair and impartial transactions are conducted in accordance with the law. The laws governing real estate transactions presume that there are certain tasks that only qualified personnel can perform. These include explaining the finer details of real estate and the content of a contract (“Explanation of Important Matters”). The real estate notary attests to the completion of such legal tasks by affixing his or her name and seal to the document. The act sets an upper limit on fees an agent can charge: 3% of the sales price plus 60,000 yen plus consumption tax [This statutory rate is applicable only when the property price exceeds 4 million yen]. The brokerage fee is payable to the agent of the same day the sales and purchase agreement is signed and concluded

Dual agency is the situation where one agent represents both the seller and the buyer in the same transaction. The Japanese Civil Code generally prohibits representation of both parties with different interests as it would likely create an inherent conflict of interest. Real estate brokerage, however, is an exception to this rule. Dual agency is permitted in Japanese real estate transactions and is, in fact, an established norm under Japanese law and customs.