The Most Common Investment Structures in Japan

Minimizing taxes and limiting risk contribute to an attractive return on investment. An important legal vehicle for doing this is the Special Purpose Company (SPC).

Two common SPC structures used for real estate investment in Japan are the GK-TK and TMK. These investment structures are mainly used in collective investment schemes, but they can also be used by an individual investor. Both the GK-TK and TMK structures limit investment liability and allow investors to avoid double taxation.

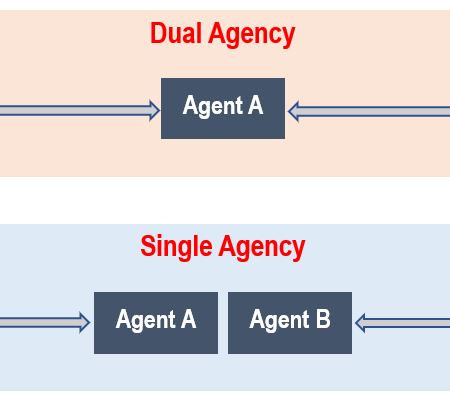

A Godo Kaisa (GK), a Japanese term for Limited Liability Company (LLC), is incorporated under the Companies Act and must have at least one member or equity holder. A Tokumei Kumiai (TK), or silent (anonymous) partnership, is a contractual relationship whereby a TK investor provides funding to a GK in return for a share of the profits and losses of the relevant business.

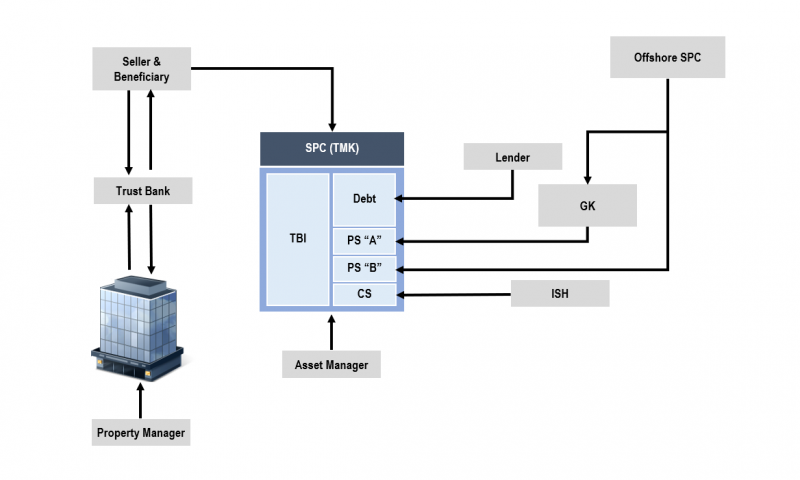

Tokutei Mokuteki Kaisha (TMK) is an SPC governed under the Asset Liquidation Law. A TMK can only be established and used in connection with the securitization of certain assets. A TMK can only issue “preferred equity” and “specified bonds” to fund the purchase of certain assets. Before the TMK can commence business, it must file an Asset Liquidation Plan with the Financial Services Agency (FSA).

The main difference between the two structures is that TMK is subject to stringent regulatory requirements whereas the GK-TK structure has simpler rules of governance.

The choice of appropriate investment structure must take into account regulatory, taxation, and other consideration relevant to the situation of potential investors. We urge you to consult with legal and tax experts for information and guidance relevant to your situation.